Resources and Tools for Students

With the complexity surrounding scholar loans, varied assets can help students in navigating financial selections.

Resources and Tools for Students

With the complexity surrounding scholar loans, varied assets can help students in navigating financial selections. Websites similar to BePick present priceless details about student loans, offering detailed evaluations, comparisons, and steering on managing mortgage funds effectiv

How to Handle Delinquent Loans

Addressing delinquent loans requires a structured strategy. The first step is to evaluate the current monetary situation comprehensively. This entails inspecting all debts, revenue sources, and necessary dwelling expenses to establish areas for adjustm

Once the financial panorama is obvious, debtors ought to prioritize their money owed. Focusing on high-interest loans first can mitigate extra prices and doubtlessly enhance credit scores sooner. Stability can usually be achieved by way of strategic compensation pl

n Improving your credit score score, decreasing present money owed, and demonstrating a stable income can enhance your chances of securing an Additional Loan. It’s additionally useful to buy round for one of the best loan merchandise, as totally different lenders have various standards and choices. Consider getting ready a solid mortgage utility that outlines your mortgage purposes and repayment pl

Considerations Before Applying

Before applying for a Monthly

Same Day Loan, it’s essential to consider various factors. First, assess your current monetary state of affairs. Determine how much you can realistically afford to borrow and repay every month without compromising your finan

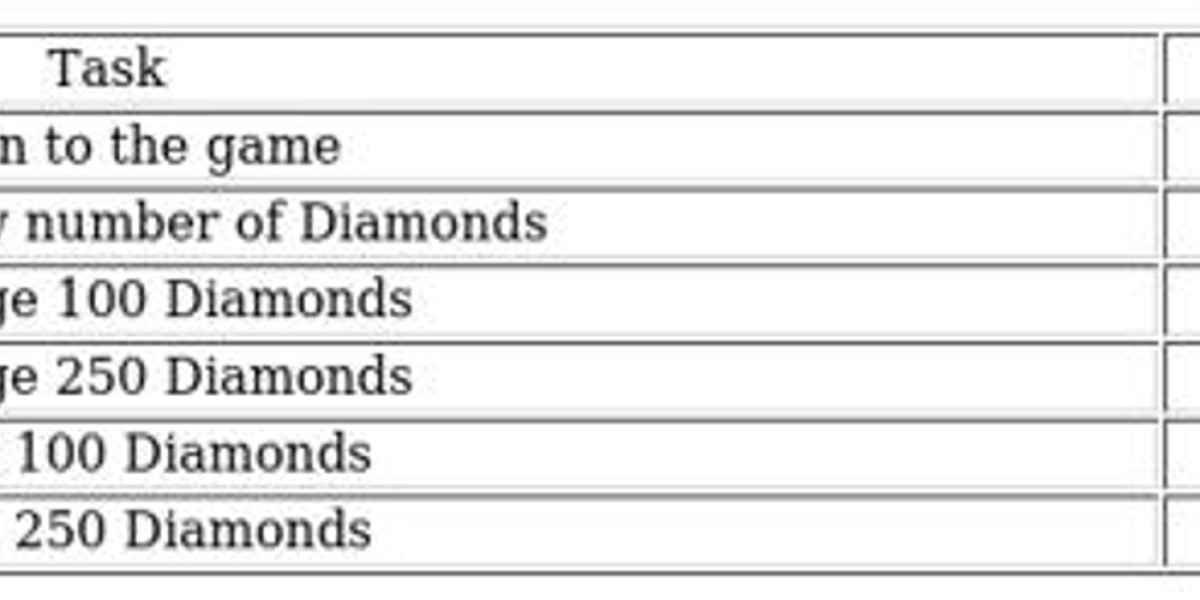

Repayment Plans and Options

Once students graduate, the subsequent step is repayment. There are a number of compensation plans available for federal pupil loans, together with Standard Repayment, Graduated Repayment, Extended Repayment, and Income-Driven Repayment Plans. The Standard Repayment Plan sometimes has a fixed month-to-month fee over ten years, whereas Graduated Repayment begins with lower funds that increase over t

It's additionally clever to concentrate to the mortgage's interest rates and whole costs. Occasional checks on your monetary health might help you identify whether refinancing could probably be advantageous. Make an effort to take care of open communication along with your lender, as they might offer strategies for higher administration or compensation choices in instances of prob

Generally, worker loans supplied by your employer don't impact your credit score rating in the identical method traditional loans do. Since these loans are usually deducted out of your paycheck, they often don’t require a credit check. However, making certain timely reimbursement is important as a end result of any defaults or missed funds may doubtlessly affect your standing throughout the gr

If borrowers can't repay the mortgage throughout the agreed timeframe, the pawnshop will promote the item to recoup its losses. Therefore, it’s crucial to plan payments forward of time to avoid dropping useful possessions. Clear communication with the pawnshop about your reimbursement Unsecured Loan plans can help foster a better borrowing relations

Managing Your Additional Loans

Once you've got

Unsecured Loan secured an Additional Loan, the focus shifts toward responsible management. This includes setting a budget that comes with your mortgage reimbursement schedule alongside other financial commitments. By prioritizing your obligations, you can avoid lacking payments, which may negatively impression your credit score rat

Whether or not employee loans are price it is decided by individual circumstances. For many workers, the accessibility and favorable phrases make these loans a priceless financial device. They can stop people from falling right into a cycle of high-interest debt and supply necessary funds during pressing situati

This structure offers comprehensive and actionable info on scholar loans whereas also introducing BePick as a priceless useful resource for faculty kids looking to navigate their monetary options successfu

By visiting 베픽, borrowers can access articles, recommendation, and critiques related to managing loans, serving to them regain control over their financial commitments. The insights shared can empower customers to make knowledgeable selections concerning their borrowing practi

Applying for an worker loan usually entails reaching out to your HR division to specific your interest. Most organizations have a structured utility course of that may require you to fill out forms detailing your monetary wants and repayment capabilities. Documentation such as proof of revenue and identification can also be essent

Additionally, employee loans may help enhance the financial literacy of workers. Companies that supply financial education alongside their mortgage programs can empower staff to handle their finances higher, resulting in a extra educated workforce. This knowledge benefits the company as staff who perceive monetary management are usually much less more probably to face financial cri

Онлайн магазин, в котором возможно заказать диплом университета

By sonnick84Что нужно, чтобы заказать диплом в сети интернет?

By sonnick84Где безопасно приобрести диплом

By sonnick84 10 Undeniable Reasons People Hate Virtual Mystery Boxes

By casesgg1437

10 Undeniable Reasons People Hate Virtual Mystery Boxes

By casesgg1437Достигните новых высот в карьере

By sonnick84